Students of to deal with various academic writing activities throughout the semester for each subject. It is difficult for the students to meet the essentials for all subjects and all kinds of assignments. Essay writing is one of the assignments that students have to perform for all kinds of subjects. The basic objective of essay writing is to give the correct understanding to the students about the selected topic of the essay writing. It also helps teachers to provide the right amount of knowledge and the concepts to the students in the best possible way. However, it is not easy for the students to meet the requirements of essay writing and other academic writing activities at the same time.

Students find it difficult to write for finance as it is a wide and vast field that requires a lot of effort along with the commitment to complete the finance essay writing. The struggle of the students is highly appreciated as they not only have to complete the assignments but also have to maintain their grades throughout the semester. To complete their assignments, students approach different online essay writing services to complete the desired writing. This helps the students to complete their assignments and to maintain their grades at the same time.

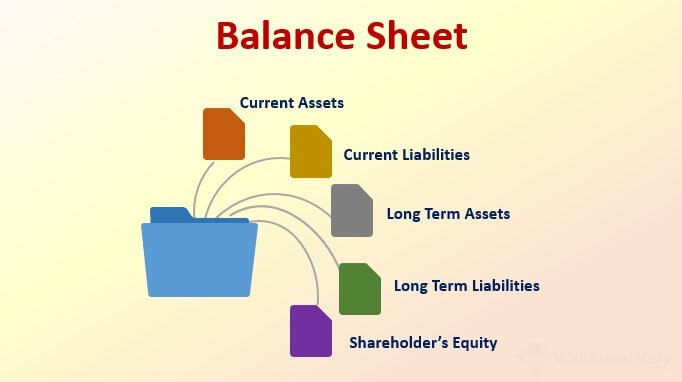

What Is Balance Sheet?

The balance sheet is one of the financial statement which includes the assets liabilities and shareholders’ equity of the organisation at some specific time. The balance sheet helps to compute the returns and evaluate the structure of the capital. It gives the right idea of what exactly the company has as in assets, what it owes, and what exactly is invested by the shareholders. The balance sheet is used along with other financial statements such as income statement cash flows financial ratios and many others.

Characteristics of Balance Sheet

Following are some of the basic characteristics of the balance sheet;

- A balance sheet is one of the statements which involves the assets liabilities and the shareholder’s equity stating at the specific financial period which defines the position of the entire organisation.

- It is always prepared at some specific end of the period, which is why it is called a periodical statement as well.

- It is also known as an unallocated cost statement as the entire portion of various costs should be written off in the future.

- It is a misconception of the students that the balance sheet is the competing statement of the other financial statements, such as income statements. However, the balance sheet actually supports the income statement and is also known as the complementary statement.

- It also serves its purpose as an interim report.

Importance of Balance Sheet

The balance sheet is one of the financial documents that help the owner of the business to keep itself and other stakeholders informed about the financial standings of the company. I have seen many organisations getting in trouble because of the lack of knowledge about the financial condition of the organisation. they recognise the condition of the company when it’s too late to act. This happens when the owner of the business or organisation doesn’t pay attention to examine and study the balance sheet and other financial statements of the company.

It is a study that if your acids to liability ratio are less than 1 to 1, then there are many chances that you are going to be bankrupt. In such a condition, owners of the businesses should select and implement some financial strategies to cope up with the challenges effectively and efficiently. A good and stable balance sheet will help the organisation and the businesses to get additional loans and credits from the banks as the bank sees the stability of the organisation and approve the loan based on financial statements. A good and stable balance sheet also helps the investors to see whether their investment is going the right way or not.

Essentials of Balance Sheet

The entire balance sheet is categorised into three mean components that our assets liability and equity. The items mentioned in the balance sheet can be varied as their dependent on the nature of the business however, in general, the balance sheet is divided into three categories only. Let’s see and discuss them in detail;

Assets

Assets are categorised into two types, liquid, and non-liquid assets. Liquid assets are referred to as those assets which can be converted into cash easily while non-liquid assets are those with cannot be converted into cash as quickly as the liquid assets. This also includes some intangible assets such as copyright patents and many others.

Liabilities

Liabilities are defined as the funds owned by the organisation. Liabilities are further divided into two categories that are current and long term liabilities. Current liabilities are defined as the ones which should year-end within a year, on the other hand, long-term liabilities are those which last long for more than a year. Current liabilities include accounts payable, loans, interest, taxes, and many other things.

Shareholder’s Equity

Shareholder’s equity is which remains of subtracting the liabilities from the assets. furthermore, retained earnings are the one that is retained by the organisation and are not paid to the shareholders in the form of dividends.

Conclusion:

All organisations and businesses need to prepare financial statements to check the current financial standings of the organisation for the sake of the shareholders and the company.